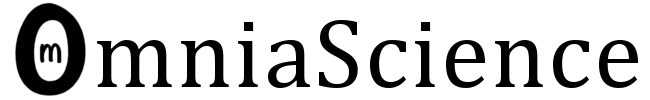

Research on the Competitiveness of Crediting Rating Industry using PCA Method

Abstract

Purpose: This study investigates the industry competitiveness problem, which plays an important role in crediting rating industry safety. Based on a comprehensive literature review, we found that there is much room to improve regarding of competitiveness assessment in crediting rating industry.

Design/methodology/approach: In this study, we propose the PCA (Principal Component Analysis) method to illustrate the problems.

Findings: America and Canada’s companies (such as S&P and DBRS) take the leading place in credit rating industry, and Japan’ agencies have made great progress in industry competition (such as JCR), while China’ agencies are lagging behind (Such as CCXI).

Research limitations/implications: It requires multi-year data for analysis, but the empirical analysis is carried out based on one-year data instead of multi-year data.

Practical implications: The research can fill the gaps for credit rating industry safety research. And study findings and feasible suggestions are provided for academics and practitioners.

Originality/value: This paper puts forward the competitive indicators of credit rating industry, and indicators of cause and outcome are considered.

Keywords

Full Text:

PDFDOI: https://doi.org/10.3926/jiem.1275

This work is licensed under a Creative Commons Attribution 4.0 International License

Journal of Industrial Engineering and Management, 2008-2026

Online ISSN: 2013-0953; Print ISSN: 2013-8423; Online DL: B-28744-2008

Publisher: OmniaScience