Under-performance of listed companies? Real earnings management and M&A: Chinese empirical evidence

Abstract

Purpose: The purpose of this paper is to examine whether acquiring firms attempt to adopt real earnings management strategy to upward reported earnings in the period of M&A announcement and provide an explanation for the underperformance of post-M&A in share payment M&A affairs occurring in China’s capital market from 2008-2010.

Design/methodology/approach: The author uses Roychowdhury’s(2006) methodology to measure the magnitude of real earnings management of acquiring firms in stock for stock M&A by exploiting financial date from 2006 to 2011. The methodology includes three models, which are cash ?ow from operations, production costs and discretionary expenditures, respectively.

Findings: It was found that firms using stock as a financing medium exhibit significant negative abnormal cash flows and abnormal discretionary expenses yet abnormal production costs significantly positive during the current period of M&A. Moreover, it was also documented that acquiring firms use real activities manipulation to overstate earnings for the purpose of improving market confidence. Finally, a negative association was found between REM and under-performance of post-M&A.

Research limitations/implications: To some extent, these results explain the puzzle of performance decline over the following period of post-M&A. Meanwhile, our study adds to prior literature that capital market pressures induce acquiring firms inflate reported earnings by manipulating real activities in stock-financed M&A occurring in China’s capital market.

Practical implications: The author’s result imply that investors, analysts and regulators cannot ignore more undetectable opportunism behaviors underlying reported earnings than accrual-based earnings management and the impact on the performance of post-M&A when they use financial statements to evaluate acquiring firms.

Social implications: Our study plays important role in making public policies. Furthermore, it is necessary to improve outside supervisory mechanism and strengthen construction of honesty and faithfulness so as to realize the main purpose of value creation in M&A.

Originality/value: The paper extends prior literature by taking a closer look at acquiring firms’ managerial myopia behavior in stock-financed M&A. The administrators of acquiring firms have strong incentives to manage earning upward by adopting a more subtle way which is a costly means because it has value-destroying effect on performance of post-M&A.Keywords

Full Text:

PDFDOI: https://doi.org/10.3926/jiem.1330

This work is licensed under a Creative Commons Attribution 4.0 International License

Journal of Industrial Engineering and Management, 2008-2026

Online ISSN: 2013-0953; Print ISSN: 2013-8423; Online DL: B-28744-2008

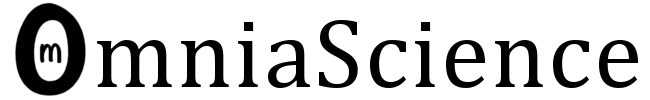

Publisher: OmniaScience